We all want to get rich fast and join that elite group – the millionaires! But can you become a millionaire in the next 5, 10 or 15 years.?

Trust me, I’ll grab my bullhorn for that: A big “Y” to the “”ES.”

Now before you read on…

This post is going to be a challenge. Some of the methods here are actually the plans I’ve already set for myself. So, if are you ready to jump on the challenge, let’s kick the ball rolling…

1. Know your Current net worth

I know you don’t want to sit on the couch all day fiddling with numbers. But, you can’t grow your net worth if you don’t know your current financial level.

Your first hack to become a millionaire is to know where you are presently – and clearly mark what you are doing right on wrong. You need a clear plan.

It’s fun to throw shots in the dark and see what sticks, but don’t do it with your finances. So, let’s see these 3 questions:

- What is your current full-time income?

- Does your income allow up to $500 savings upward a month?

- Do you know your current net worth?

Why does it matter?

If you know your current net worth, then you ‘d know what to do to grow: Get more income streams, Increase your savings, start a business or Invest more.

You can use my free budget tracker or even a simple excel to track your budget.

2. Get Rid of the Elephant’s Rope

The second thing to do on your plan to become a millionaire is freaking harsh. But, seriously, you need to do this.

“Kill your debts”

I know we get some debts on good accounts. A student loan is one. But your debt is your Elephant’s rope!

It limits you, controls your life and your decisions, like: How much you can save, or how much will go into your retirement plan.

So, how do you deal with your debt?

Here are 5 easy ways:

- Negotiate for debt relief

- Refinance with low interest loan

- Pay More Monthly

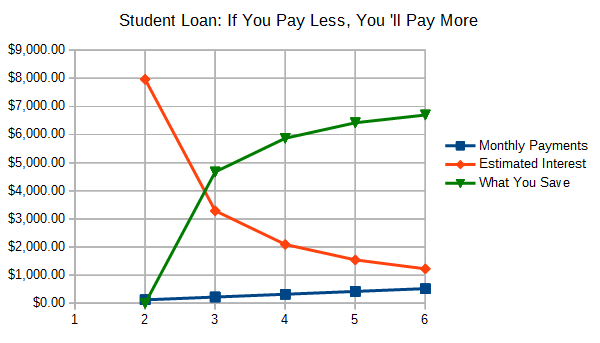

It does seem easy to go for a standard debt repayment plans. But it’s a freaking bad strategy. In fact, you will lose way more money by paying less.

Let’s see this:

If you take a student loan of $15,000 with an annual interest rate of 6% for a minimum monthly repayment of $125, you will accrue $7,965 interest over your period of payment.

But what if you go for a monthly repayment plan of $425? You will pay just $1545 on interest – and save a grand $6,420.

3. It’s a must. Spend less than you earn

You’ve probably heard it as much as Micky wore his gloves. But I feel like grabbing a bullhorn for it:

If you want to increase your net worth, then you need to earn more money than you spend.

There are two ways to that:

- Cut excess expenses: If you earn well above your living costs already, then you need to start putting all the money you spend on unneeded expenses into your investment.

- Get new income streams: See the next point.

4. Track your hidden income sources

Your unused income sources are possible income sources that are probably available to you, but you are not putting them to use.

Let’s see some examples:

- Get your purchases for less money: Swagbucks.

- Use your spare Resources: Your spare car – Get Around.

- Your spare time: Instacart.

- ReNegotiate your bills.

- Ask for a salary raise.

But how much can you make from this? Let’s see:

- Get Cashback: If you spend $500 a month on groceries, and you get 5% cashback with Swagbucks, that’s an extra $25 a month.

- Instacart: An average Instacart shopper earns about $13/hr. If you spare 3 hours of your weekend, you should earn an extra $156 a month.

- Airbnb: An average homeowner makes $924 a month on Airbnb.

Now using your hidden income sources, you should at least get $500 a month.

So how much is that in a year? $60,000.

But there is one more thing: You are not going to be spending that money. Here is a better plan:

Add it to your investment plan.

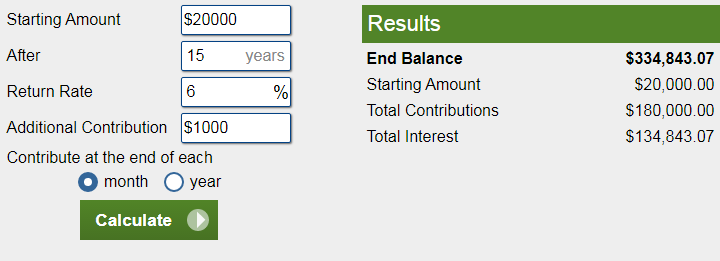

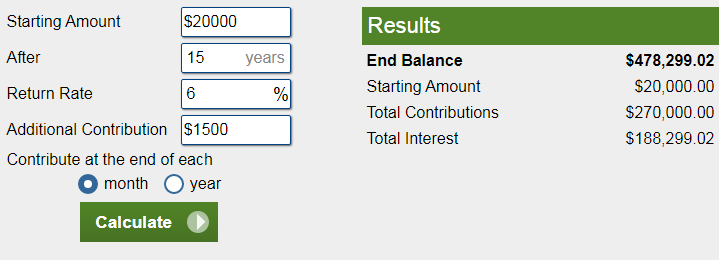

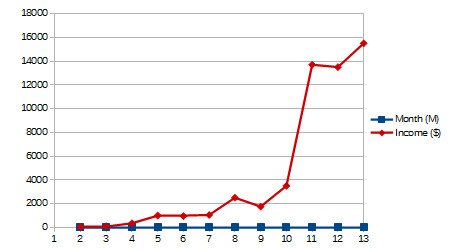

But what difference would it make? Let’s imagine an investment of $20,000 with a 6% rate and a monthly contribution of $1000.

Without $500:

With the extra $500/m:

If you add $500 to your investment plan, both the $1000 and the yearly interests you accrue will also compound over the years. So how much do you make?

5. You need business and investments

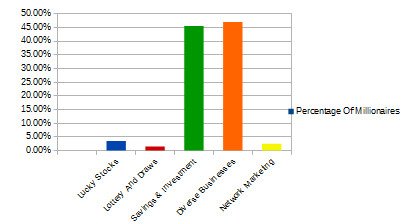

How do 91% of millionaires make their money? Let’s see this:

- 45.5% of Millionaires make their money from savings and investment

- 47% of Millionaires make their money from business

Well, I don’t think that’s shocking.

If you look around, you can easily see that most millionaires are in one kind of business or the other.

The truth is: 99.9% of the time, you can’t get rich from a 9-5 day job.

And the education system is flawed. It has succeeded in wiring us to think as workers.

“Go to school, get a job, start working for someone, and get paid to live and continue working for him”.

It’s a bad cycle – designed to make the workers work more – and the earners earn more.

Have you ever wondered:

- Why are the CEOs of Silicon valleys so rich while it’s actually the programmers grinding their heads on the desks?

I think here is the answer: The school system!

Now, does it mean day jobs are bad – and that you shouldn’t work for someone? No, but it does mean something:

While you are at it, you should be planning ahead for yourself: how to break from the cycle by having a side business.

6. Take advantage of your low-Cost High ROI Investment

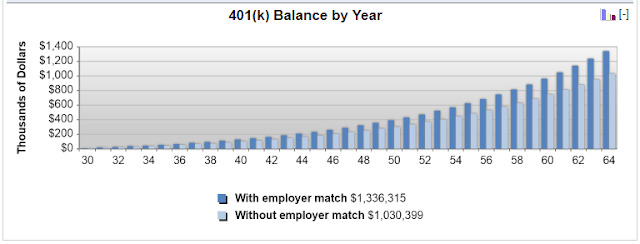

First, I’m not going to tell you to jump on a lucky stock. So, what’s more real? Your 401k. You want the figures?

See this:

If you earn $50,000 a year and you invest 10% into your 401k and your employer matches it with 50% of 6%? How much would it yield before your retirement? $1,336,315

7. Don’t chase stocks with investments

Investment is more or less like your kitchen knife. Okay, I will explain.

Your kitchen knife is just a tool. When you use it to chop vegetables, you are putting it to good use. But if you chop too fast, you risk hurting your fingers.

Investments work the same way.

The truth is: You can’t predict what will happen to the stock market. So it’s pointless chasing after the next Amazons, apples, or Google.

What you can do instead:

- Minimize your risks by spreading your investment across different asset classes: stocks, bonds, and cash equivalents.

- Take advantage of compounding investments: Interest yielding and dividends paying stocks.

8. Start Your Online Business

If you really want to break out of the 9-5 day job, and make some monster money, read this: The best way is to start your online business.

But how much can you make?

Let’s do some math:

If you sell $75 product to 900 people in one month, how much do you make?

$67,500.

In one year? $810,000.

I know, it will take you some time. But, if you are patient to know what your audience wants, and you stick with it, you will see this in 2, 3 or 5 years:

Furthermore, you don’t need to be a rookie to launch a profitable online business.

- Identify your sellable products: physical products, your knowledge or expertise: e-books, printables or online course?

- Promote your product: You need a blog

- Drive Target traffic: And convert your traffic to sales

9. To become a millionaire, Widen Your Reach

There is one key lessons I learn’t from studying the lives of successful startups. And here it is:

“What you know can only take you so far, whom you know takes you much farther”.

See this:

- Paul Terrell helped Apple to make it’s 30 orders when the newly formed company was turned down by Homebrew.

But, what if Steve Jobs never made attempt to meet him?

May be Apple wouldn’t have been born.

So, how much do you think you can make with your skills this year? $50k, $1 Million dollars.

The truth is: What you can make with your skills has no limit, but, your skills won’t make you any money if no one knows you.

It doesn’t matter if you are a ‘code monkey’ type of programmer. If no one knows you, you won’t make money.

5 weekly goals to widen your reach and grow your network:

- Write out the names of top 25 experts in your field.

- Find out a social media account they are most active on.

- Search for their Email Address.

- Attend events they are featured – Yes, you’ll spend money. Is it worth it? Yes.

- Walk up to them and introduce yourself.

- Don’t stop. Keep it up.

Yes, I know you would only likely make just 1 or 2 friends off the names on your list.

But don’t forget: Just one connection can show you to the world.

10. Read books about how rich people make their money

You might have heard the cliche ‘knowledge is wealth’. It’s not just a cliche.

Here it is:

Some of the best secrets hacks to become a millionaire are hidden – in books. And you know, wealth building begins with having the right ideas. Just a flash of thought can change the course of your life.

The more you expose yourself to knowledge, the more ideas you can generate.

Reading about those who have built great businesses and investment empires will open you up to new scopes of thinking and spark your ingenuity to generate wealth-building ideas.